XTPL - what about unprofitable Polish high tech company? (English translation)

XTPL is a Polish company that has developed a technology for the creation of printed electronic connections in units of micrometers (1 micrometer = 1/1000 of a millimeter), which can be used even on an uneven surface (they call it topography). XTPL is now loss-making, however, they should be close to break-even in 2024, and according to their 2023-2026 strategy, they want to reach PLN 100 million in sales in 2026, which would mean high profitability and likely multiple share price appreciation.

I came across XTPL thanks to the analytical company East Value Research. In my opinion, very high-quality analysts, dealing with investment opportunities mainly regarding small companies in Poland and other Central European countries. I'm writing this here just for context, East Value Research is a close contact with XTPL and I relied heavily on their materials and also the tweet of their chief analyst Adrian Kowollik when researching XTPL. I definitely recommend it to those interested.

Technology and product

XTPL has developed a technology where they use nozzles to spray ink containing metal particles onto the surface and then use an electric field to gather the particles together, evaporate the liquid component and create a conductive connection. The ink has the properties of a non-Newtonian fluid and the machine from XTPL can change its viscosity during application so that it is highly viscous in the nozzle and outside on the surface, but on the other hand when it passes out of the nozzle it is not very viscous and thus there is a problem-free application and no clogging miniature hole. Physics has never been my forte, so these videos can explain it in more detail.

(interview with CEO Filip Granek, do not leave because of German at the beginning, the interview is in English, great video as an introduction to XTPL)

They are now the only ones in the world who have the technology to print electrical connections in dimensions at the level of micrometer units (up to 1 micrometer, in the future even less) in combination with topography (according to the CEO's statement in an interview about a year old, but I have not noticed any change). They have 33 global patents associated with this technology and more pending. This technology can be used in the correction of manufacturing errors in OLED displays, in VR technologies, to connect multiple chips together etc. The CEO also talks about the future in medicine or telecommunications. These are all growing economic segments, and in the case of the adoption of XTPL machines, the company has a very good future ahead of it in my opinion.

XTPL currently offers three types of products, the first are the so-called “Delta machines”, then things related to operation and maintenance, such as inks and nozzles, and thirdly, tailor-made solutions for industrial use.

Delta machine is a complete set, when XTPL supplies you with a whole table with equipment, software, etc. This is mainly used for research and the customers are either university research institutes or research departments of large electronics companies. One such machine will cost around PLN 750,000.

Nanoinks and consumables are another product. There is not much to talk about here, from the point of view of the numbers, it is only important that in the case of wider adoption, these items would make up around 50% of sales, which would be so-called reccurring revenues, so relatively certain, predictable sales.

And finally, there are custom components and industrial solutions. For XTPL to grow further, it is important that they acquire industrial clients. According to the latest reports, they are dealing with 20+ clients, of which 9 are in the stage of designing an industrial solution, 4 are in the stage of manufacturing, shipping or testing prototypes, and according to East Value Research, the first client is likely to implement the solution from XTPL into mass production in the second half in 2024.(https://eastvalueresearch.com/2024/05/) According to the CEO, each adoption into mass production should bring in sales of around 100 million USD over the course of several years. So it only takes a few industrial clients to reach the target of PLN 100 million per year.

As for XTPL's competition, there are companies providing similar technological solutions. The CEO talks about the competition in the interview above, according to him, each company comes with a different technology that is suitable for different use cases and hopes for a "peaceful coexistence". XTPL has a monopoly in its niche market segment (sub 3 micrometer topography) and its technology is patented, if anyone wants to compete with them, they have to invent their own solution, sell it to customers, etc. which would take some time. Of course, the situation on the market needs to be monitored. As for the risk of copying technology, the CEO cannot imagine how the Chinese would be able to disassemble and copy their technology, moreover, the machines come with their own software, which should also be resistant to copying.

Balance sheet, sales, profits and strategy 2023-2026

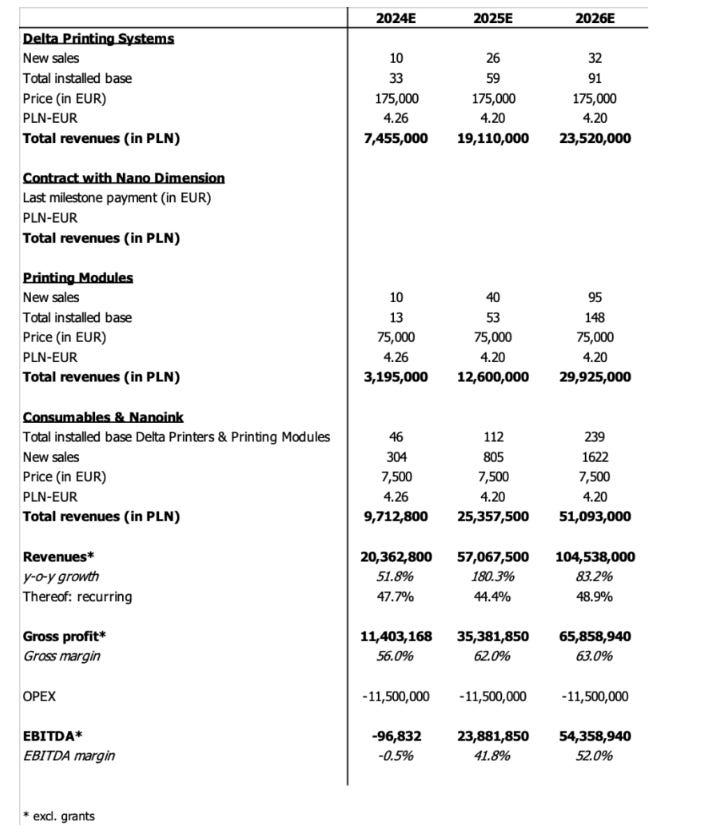

XTPL has adopted a strategy where they want to reach close to break-even in 2024 and PLN 100 million in sales in 2026, which at its margins would represent a roughly estimated profit of about PLN 40 million. In 2023, they invested in production capacity and marketing to make enough products and have enough customers to meet this goal. At the same time, they have reached PLN 13.5 million in sales in 2023, so 100 million is a long way to go, on the other hand, they are growing from a very small base of machines sold, and success in industrial adoption of their machines would bring them very close to that goal.

Figures for 2022 and 2023

Estimates of East Value Research in case of fulfilling the strategy of reaching PLN 100 million in sales by 2026

According to report from May 2024, they have PLN 20 million in cash and their burning rate of this money is PLN 2-2.5 million per month. Ideally, they should turn a profit soon, however, if they need additional financing, they have arranged up to PLN 30 million more that they could borrow. In the past, they financed themselves largely by issuing new shares, which explains the relatively low debt and also the smaller share of the CEO in the company, although he still has 13,98%. As for the impression of CEO Granek, he is a founder CEO who has already experienced a lot with the company and finally has a product in his hands that he can sell, subjectively he seems to me to be a competent and intelligent person, let the reader judge for himself from the videos.

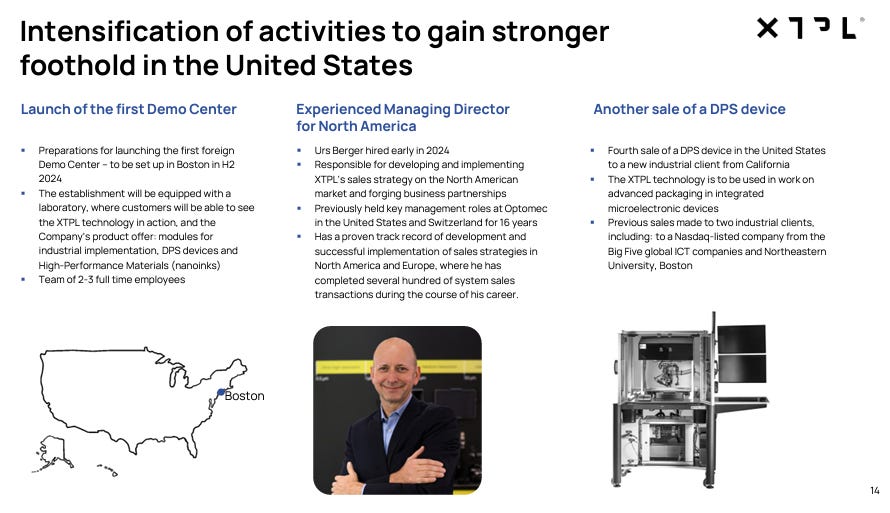

XTPL has decided to adopt a strategy of commercializing their solutions from 2023, and has invested heavily in marketing and increasing production capacity. They are visiting various trade fairs, establishing contacts with distributors, they have established a branch in the USA and are preparing branches in Asia, they have hired a lot of new employees.

Napkin math pricing and summary

At a share price of PLN 120 as of 7/8/2024, the company's valuation is at a total value of PLN 278 million, plus they have around PLN 14 million in debt and probably around 17 million in cash, which is still being burned. It is important that they get their strategy right and stop burning cash and instead start making money. If this were to work out, then if we are based on the estimates of East Value Research, i.e. EBITDA of 24 million for 2025 and 54 million for 2026, and if I round taking into account the cash burn to EV 300 million, then we would be to 2025 EV/EBITDA 12.6 and 2026 EV/EBITDA 5.5. If I were to deduct the 19% tax, the multiples would be 15.4 and 6.8. If I conservatively value the company at 20 times, then we are at a share price of PLN 156 (+30%) and PLN 354 (+195%). Of course, everything must go according to their strategy, on the other hand, such a high-tech company would probably have an even higher valuation multiple and the prospect of great growth in the future with stable profitability. If they continue to do well, in 5-7 years the price of one share can easily be 10x the value.

I see XTPL as a company that is likely to turn a profit soon and has great potential. And if their strategy succeeds, I think they are selling very reasonably priced relative to future earnings. In my opinion, the chance that they would not make a profit soon is very small, on the contrary, the potential for scaling and rapid growth is huge, especially from such a small base.

All feedback and constructive criticism is welcome.

Links:

Investor relations - https://ir.xtpl.com/