Vilkyskiu Pienine aka Vilvi Group (ticker VLP1L.VS) is a Lithuanian group of companies engaged in the production of dairy products. I estimate their 2024 earnings at 21 million Euros, against which they trade at a valuation of 87 million Euros (2024 P/E is therefore about 4), plus they have about 30 million in debt and 1.5 million in cash. Vilvi Group has also managed to achieve very decent revenue and earnings growth in recent years. As for the quality of their business, the dairy market is a saturated market that has some cyclical risks, but after comparing it to competitors and taking into account some specifics of Vilvi Group, I think this company deserves at least increased attention.

Products

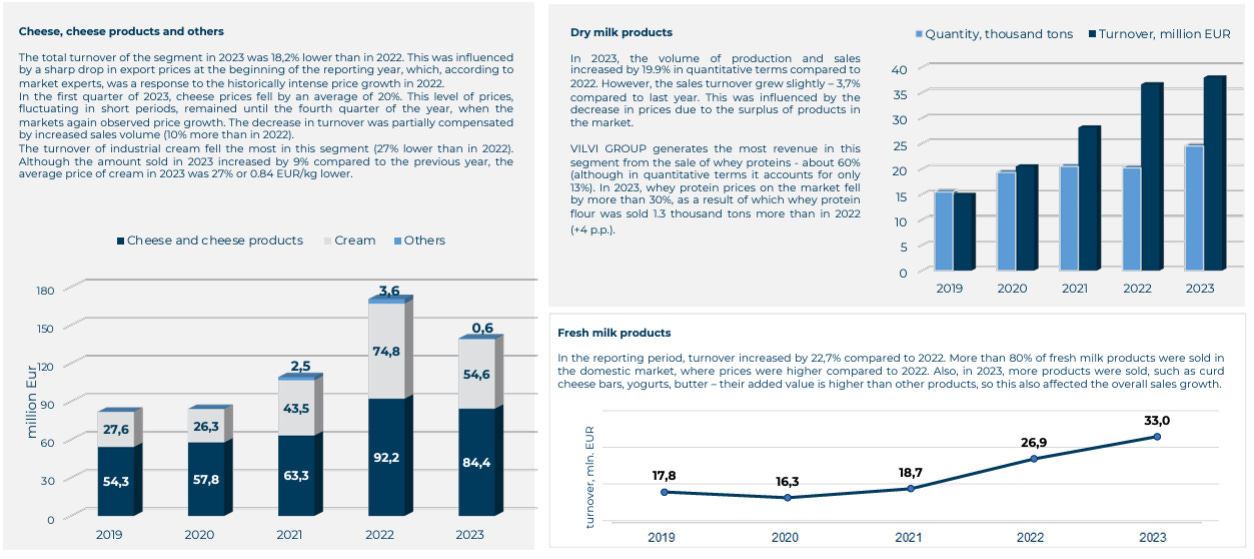

Vilvi has a wide portfolio of dairy products. Their legacy brand is Memel cheese, and they also produce other types of cheese, yoghurt, kefir and sweets containing cream. They sell both retail and wholesale. Other products are whey proteins, which they produce both under their own brands and for third parties.

Proteins and the fresh dairy product categories (kefir, yogurt, cream, butter) are higher margin products than cheese and their increasing share of sales in 2023 has helped stabilise overall margins, we will look at the numbers later.

They export their products worldwide. In the first half of 2024, about 14% of sales come from Lithuania, 55% from other EU countries, and the remaining 31% from the rest of the world.

History

The history of the company dates back to 1934, after years of socialism it was re-established as a private company in 1993. It has gradually grown in size over the years, and it is important to us that it has been operating as the Vilvi Group since 2019. Since 2019, both revenue growth and profitability metrics have also improved significantly. Unfortunately, I have not been able to trace if there has been any change in strategy or any entry of foreign capital. They bought 70% in Latvian dairy company SIA Baltic Diary in 2020 and bought the remaining 30% in 2023.

Financial figures

On the slide we can see how the financial metrics have changed since 2019. Vilvi Group is now a very financially healthy company. As for this year 2024, in the first half they achieved sales of 117 million Euros and a profit of about 10.5 million, with a net margin of 8.9%. Then for months 7-9 they reported around 20 million in sales each month. So, if the numbers stay consistent, I estimate that they will reach 237 million Euros in sales this year and if we give an 8.9% margin as a guide, the profit would be 21.1 million Euros.

Despite the drop in sales from 2022 to 2023, Vilvi reported a higher profit due to the higher share of protein and fresh milk products in total sales. Protein and fresh milk products have higher margins and are very important in Vilvi's product portfolio.

Growth, capital allocation, owners

What does the future look like for growth? There's one thing that should increase revenues in the future. Vilvi Group has entered into an agreement to build a new dairy plant for EUR 50 million under the Latvian firm SIA Baltic Diary. This project is financed by newly acquired debt, cash, and they also got an 8 million subsidy for it. The dairy should be completed by 2027 at the latest, and I expect it will significantly increase sales, but I do not dare to estimate exactly how much.

I honestly don't have an opinion on whether they can somehow grow organically by then. It's possible they could still increase production from current capacity, but I´ll let them surprise me.

We can see from this example what Vilki does with the money they make. I assume the profits will be used to further expand and streamline their operational capacity, or possibly acquire competing dairy companies in the Baltics. What is positive for me is that Vilvi has a dividend policy where they are committed to pay out at least 25% of profits each year in dividends. For 2024, if my estimates are correct and they earn the c21m, EPS would be 1.76 Euros per share and the dividend would therefore be 0.44 Euros per share, a dividend yield of just over 6%. Which is not bad at a payout ratio of 25%, plus there are prospects that earnings and therefore dividends would grow going forward. However, there is also the risk of margin compression, which would in turn reduce the dividend and earnings.

Personally, I would appreciate at least some buyback at the current valuation. The free float is not very high and the stock is quite illiquid, but it would make extreme sense to at least buy some shares out of the stock market, especially since Vilvi was trading much cheaper not long ago. Given that the share count hasn't changed in at least 5 years, I don't expect either buybacks or dilution, which wouldn't make any sense at all at low multiples. So you have to expect management to behave this way.

As for insider owners, two board members own quite a large number of shares, one 2.85% and the other 3.56% of the company, then some others have smaller numbers of shares. The CEO, although he has been with the company for 20 years, does not own shares. Interestingly, 60% of the company is owned by Swisspartners Versicherung AG Zweigniederlassung Österreich, a kind of insurance company that has made its voting rights available to the CEO. I'm wondering if this company bought a stake sometime around 2019 and is behind the company's conversion, but that's just my theory.

Competitive environment, cyclicality

Interestingly, several competitors of the Vilvi Group trade on the Baltic exchanges. When I researched them, the numbers clearly showed Vilvi as the best. Although the competitors were priced similarly, their earnings were much more volatile and did not show as much growth. By the way, just as an aside, I also found bank called Siauliu Bankas interesting, but now back to Vilvi.

From the material on the company and the videos I've seen of the production, I get the impression that Vilvi is investing heavily in as much automation as possible, solar panels on roofs etc. which is important because in this lower margin business every Euro saved counts. But this is just my impression, I don't have any data to support this thesis.

It is important to remember that the whole European agriculture and food industry is heavily regulated and subsidised both by the EU and nationally, and an ecosystem has been created in which any new changes in regulation or subsidies could make quite a mess. But at the moment, what is playing into Vilvi´s hands are in the europian markets context cheap farmgate milk prices in the Baltics, a factor that could be compounded as Western European countries regulate their farmers. At least that was part of the thesis of Floebertus, whom showed me Vilvi and with whom I corresponded about this. I consider it a possibility, but it's not somehow critical to me.

But certainly, given the nature of the business, factors such as the cost of inputs, the price of energy or the rising cost of labour can affect Vilvi's margins. This must be taken into account. However, given the "cheapness" of Vilvi, I have a certain threshold where I am able to tolerate any margin compression. I was quite positively surprised how the energy crisis of 2022 and its impact was not visible on Vilvi's numbers, but at the same time that year there was huge demand and record sales, which probably helped to offset it. There are a few pages of risks in the annual report, I think management knows the segment well and is able to react to the difficulties.

Summary

Vilkyskiu is a company that is primarily cheaply priced, and in my opinion the price absolutely does not match the growth potential. While there are unknowns and risks, Vilvi may very well be around for many more years, continue to grow, pay a dividend and possibly increase it, or management may discover buybacks. I will of course continue to monitor the company, and owning the stock would need to be reassessed on any negative news. I think the investment may make sense given the price and that Vilvi deserves a higher multiple after all. I have decided to do a medium sized position. There are still some questions I'd like to get answered, I've also emailed investor relations, the question is whether they'll answer or if I'll throw it on X.

Pros

Cheap company at 2024 P/E 4

Growing business, 2027 completion of new production capacity

Broad product portfolio, brands like Memel, growing protein ratio and fresh milk products with higher margins, export to many countries

low debt

at least 25% of earnings returned in dividends

Cons

cyclical and relatively commoditized business

difficult to find detailed information about the company

Profit allocation could think more about small shareholders

Nice write-up! Seems very undervalued.

Do you think current margins are sustainable?

When will the new production facility come online? Their statements seem all over the place, I've seen 2025, 2026 and 2027..

Ahoj väčšina ich tržieb je z zahraničia najviac by ma zaujímalo ako majú vyriešenú logistiku to by mohlo v budúcnosti znížiť marže