Comstock ($LODE) (ENG)

This company has been popping up constantly on small cap fintwitter lately. After spending some time researching it, I understand why. Comstock is a company that could probably be called “deep value” because, even though its share price is totally crushed, it owns a number of assets whose value massively exceeds its market cap. In addition, it has two technology verticals with high potential, one of which is very close to launch and should be a catalyst in 2026.

Comstock is an American company that has been unprofitable for a long time, but it owns a number of assets and seems to have reached a stage where it will be able to achieve profitability thanks to the launch of its solar panel recycling branch. The thesis on Comstock has three legs:

Solar panel recycling

Bioleum

Remaining assets (mining projects, buildings, land, etc.)

The company has historically attempted to invest in the launch of precious metal mining, but this project failed and they ran into financial difficulties. In August 2025, Comstock raised $31 million in capital, which it used to pay off high-interest debt and complete investments in its first solar panel recycling plant, while the entry of institutional investors from Titan Capital added confidence to its plans.

Solar panel recycling

Solar panels have a lifespan of 25–30 years, after which they are disposed of. 90% of panels are sent to landfills and 10% are recycled. Landfilling poses a risk to the environment because toxic substances such as cadmium seep into the soil.

Recycling is done through a combination of manual disassembly, incineration of plastic parts, and chemical etching. This is where Comstock comes in. Comstock has better panel recycling technology than other companies in the industry because it is the only one capable of recycling panels 100%, making the process more economical than its competitors. It is also the only company with R2v3 environmental certification because its process is more environmentally friendly in terms of emissions than its competitors’ processes, which also increases the willingness of regulators to grant it the necessary permits for its recycling plants.

It should be noted that Comstock does not yet recycle panels on a large scale, but it recently obtained the last necessary permits and the first plant in Nevada should now be operational, with full operation expected in the first or second quarter of this year. For now, only a small test facility is in operation.

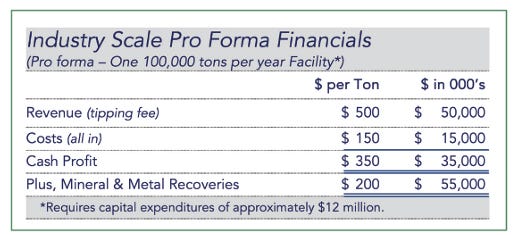

What is particularly noteworthy is the economics of this recycling business. For context, Comstock’s market capitalization is currently $227 million. The capex for building and launching a single recycling plant is $12 million. We can get an idea of the economics of operating a single plant from their investor materials.

Comstock receives a fee of $500 per tonne of processed panels from its clients, which it then recycles at a cost of $150 per tonne. This leaves them with recycled material containing a combination of raw materials such as glass, copper, aluminum, and, most importantly, silver. Silver is the most valuable component in the recycled material and has a significant impact on the economics of the factory’s operations. The table above is from September 2025, calculated at the commodity prices at that time. Since then, silver has risen 2.5 times in value, and other commodities have also tended to rise. It is difficult to estimate the exact profit at current commodity prices, partly because recycled material is sold for further processing at 50-60% of the price of the raw materials it contains, but even so, more expensive commodities have a very positive impact on Comstock’s potential profits. The prevailing opinion on fintwitter is that at a silver price of $100 per ounce, one factory could generate an annual profit of around $80 million EBITDA if it recycles its full capacity of 100,000 tons of panels per year.

That sounds very nice given Comstock’s market cap. If they manage to get the first factory up and running, they will very soon have the cash flow to build a second one, for which they already have the land and permits in the works, and they would like to have it operational by early 2027. Then two more in 2028, and up to seven in 2030. In terms of scaling, it will be the acquisition of permits rather than cash flow that will slow them down over time, as construction is actually very inexpensive compared to the profits from operation. Management also mentions that it would be possible to add their own equipment for recycling refinement, which would allow them to obtain 100% of the value from recycled panels.

If Comstock actually manages to implement this plan, it will be a very profitable investment. The company already has all the permits for its first factory and is just waiting to start operations. Once the first profits appear in the financial statements, it could be an impetus to reevaluate the shares from a loss-making company to a profitable one.

I also believe that this venture will benefit from the enormous tailwind of a growing number of end-of-life panels that will need to be recycled. The number of end-of-life panels is expected to be ten times higher in 2030 than in 2025. Their unique, more environmentally friendly technology gives them an advantage in obtaining the necessary permits. At the same time, regulators are creating a barrier to entry for competitors in this industry. That’s all for the first point.

Bioleum

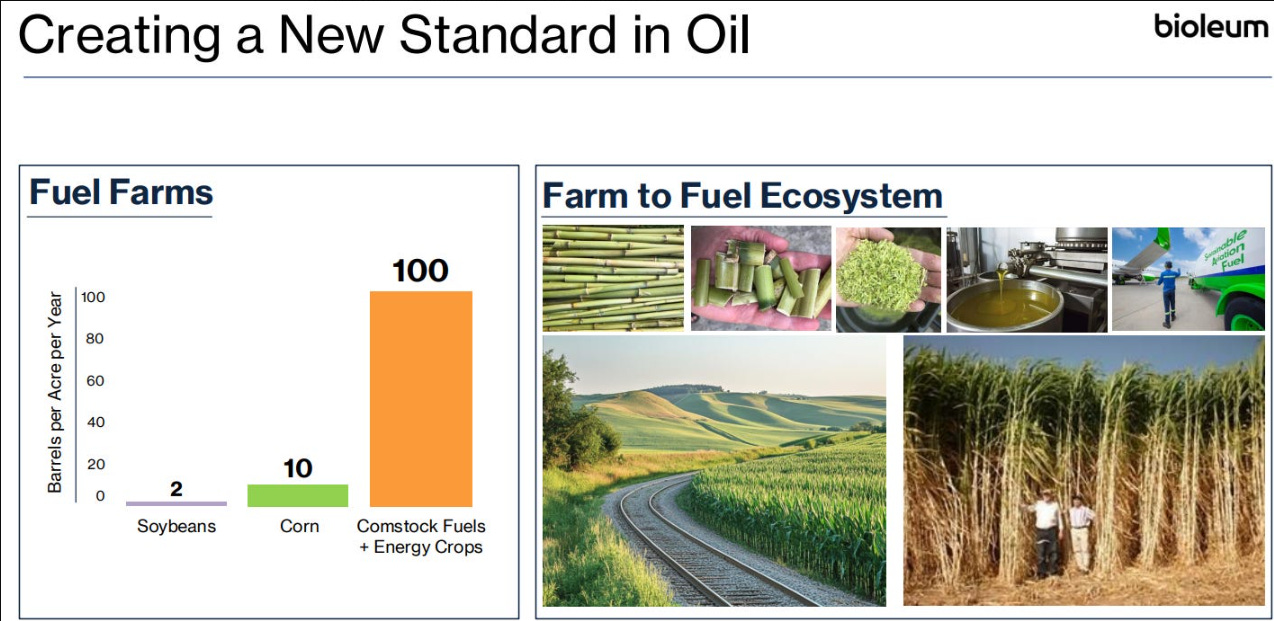

Comstock also owns approximately 70% of Bioleum, which is a separate entity. Bioleum is, in my humble opinion, a typical pre-revenues growth company with interesting technology, a kind of free option that you get when you buy Cosmtock shares. The company is involved in the production of biofuels.

Bioleum is a deep rabbit hole that I don’t want to get into too much in this blog, but in short, Bioleum has managed to create a hybrid of corn and trees that has the potential to greatly streamline biofuel production. For me, the panel recycling business is primarily important, but Bioleum certainly has potential, and Comstock estimates the value of their stake in Bioleum at just over half a billion dollars. This is based on the fact that Bioleum shares were used to pay for the acquisition of several small companies that should be synergistic for Bioleum.

Bioleum certainly has potential, but at the same time, there is a risk that management will decide to burn money on the company, so that is something I will be watching. As I wrote above, it is essentially a free option that probably has some value.

Other assets

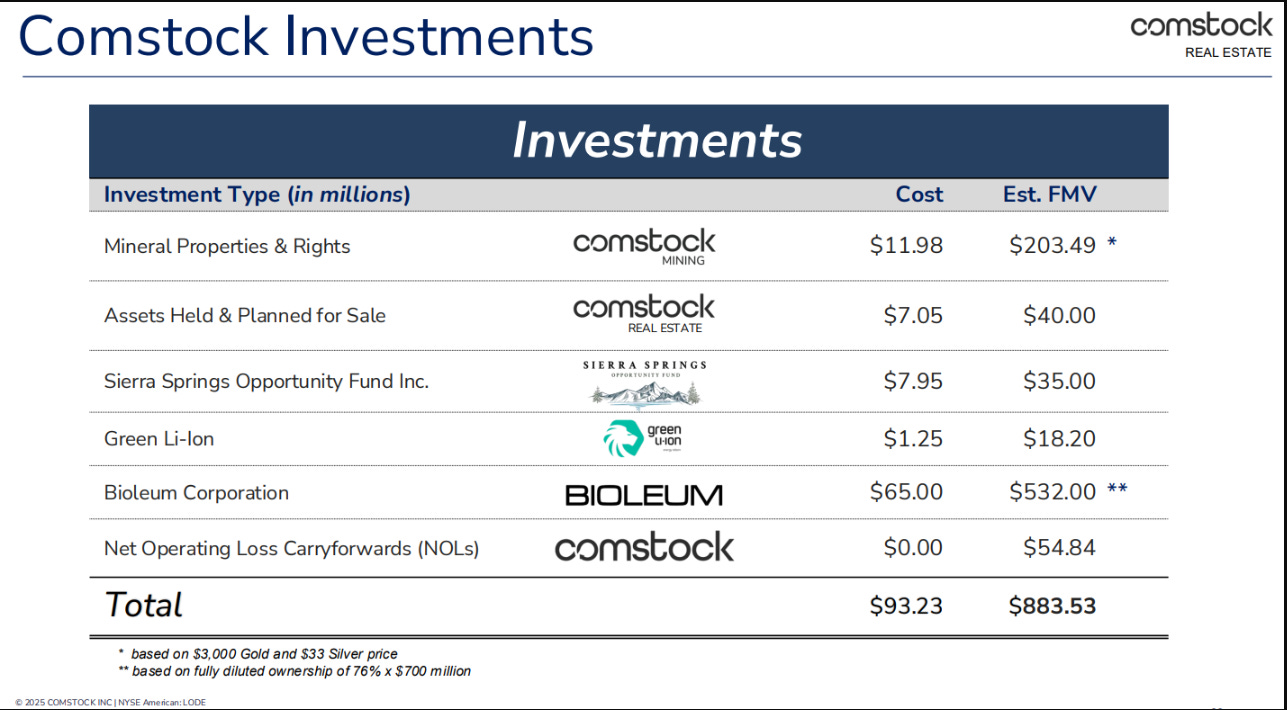

Here is a table showing Comstock’s other assets:

In addition to its stake in Bioleum, Comstock has a stake in a lithium battery manufacturing company, some real estate and land, and $55 million in losses from previous years that can be used as tax deductions. Perhaps the most interesting of these assets is their closed gold and silver mine, where mining could make sense at current commodity prices. Its value was estimated at $203.5 million, but at a time when gold was $3,000/oz and silver was $33/oz. Thankfully, management says they want to focus on scaling up the recycling business and would like to sell or lease other assets on an occasional basis, and in the case of the mining project, a joint venture with royalties for Comstock is on the table.

I think Comstock’s assets are not bad at all when you pay a valuation of $227 million for everything.

Conclusion

I feel that Comstock offers a good risk-reward ratio, even though the company is currently unprofitable. The key to further development is to launch the first recycling plant and start making money. The exposure to commodity prices, which I believe the market has not priced in, is interesting and increases the attractiveness of the investment, while the investment would also make sense even if commodity prices fell. My opinion is that Comstock’s potential is very high over the next five years.